TL;DR: Annuities can play a valuable role in retirement planning by helping turn savings into predictable income. This guide breaks down the main types of annuities and explains how each one works in real-world retirement scenarios.

- Annuities are designed to provide steady income, often for life

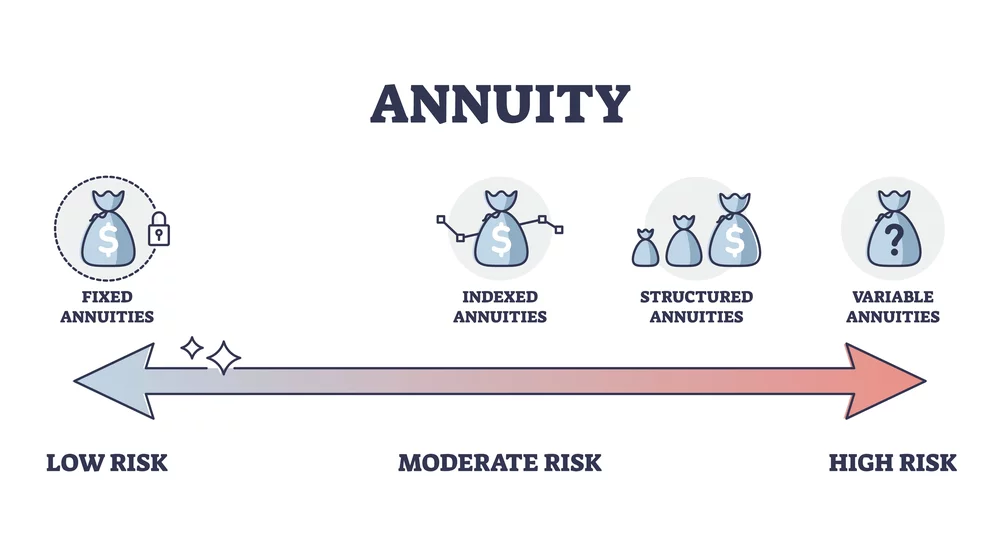

- Different annuity types balance growth potential, safety, and income timing

- Some annuities offer guarantees, while others involve market exposure

- The right annuity depends on goals, time horizon, and risk tolerance

One of the biggest retirement concerns isn’t how much you save, it’s whether that money will last. That’s where annuities come in. Understanding the different types of annuities can help you decide how to turn a portion of your retirement savings into reliable income you can count on.

At their core, annuities are contracts with insurance companies designed to provide income, often over a long period of time or even for life. But not all annuities work the same way. There are several types of annuity structures, each with distinct features, benefits, and trade-offs. Knowing how they differ is essential for building a retirement income strategy that fits your needs.

Understanding Annuities at a High Level

Before diving into specifics, it helps to understand what annuities are meant to do. An annuity allows you to deposit a lump sum or a series of payments in exchange for future income. That income can begin immediately or be deferred until later in retirement.

The wide range of different types of annuities exists because retirees have different priorities, some want safety and guarantees, others want growth potential, and many want a mix of both.

1. Fixed Annuities Explained

How Fixed Annuities Work

Fixed annuities offer a guaranteed rate of return for a set period of time. In exchange for your premium, the insurance company promises predictable interest growth and stable income payments later on.

Why Retirees Use Fixed Annuities

Fixed annuities appeal to retirees who value certainty. They are often compared to certificates of deposit, but with the potential for higher long-term income options.

Key benefits include:

- Guaranteed interest rates

- Predictable income payments

- Protection from market volatility

For conservative investors, fixed annuities are often considered one of the most straightforward types of annuity plans available.

2. Variable Annuities Explained

How Variable Annuities Work

Variable annuities allow your money to be invested in market-based subaccounts, similar to mutual funds. Your account value and income depend on market performance.

Potential Benefits and Trade-Offs

Variable annuities offer growth potential, but they also introduce risk. Income payments can fluctuate, and fees are typically higher than with other annuity types.

These annuities may be suitable for retirees who:

- Are comfortable with market exposure

- Want long-term growth potential

- Have other guaranteed income sources already in place

Because of their complexity, variable annuities are often misunderstood among the different types of annuities.

3. Indexed Annuities Explained

How Indexed Annuities Work

Indexed annuities (often called fixed indexed annuities) blend features of fixed and variable annuities. Returns are linked to a market index, such as the S&P 500, but with built-in protections against losses.

Why They’re Popular in Retirement Planning

Indexed annuities offer a balance many retirees appreciate:

- Upside growth potential tied to the market

- Protection from direct market losses

- Optional lifetime income riders

For many people seeking the best type of annuity for retirement, indexed annuities strike a middle ground between safety and growth.

4. Immediate Annuities Explained

How Immediate Annuities Work

Immediate annuities begin paying income shortly after you invest—often within 30 to 60 days. They are commonly purchased at or near retirement.

When Immediate Annuities Make Sense

These annuities are designed for income, not growth. In exchange for a lump sum, you receive guaranteed payments for a set period or for life.

Immediate annuities are often used to:

- Cover essential living expenses

- Create pension-like income

- Reduce longevity risk

They are especially appealing for retirees who want income now rather than later.

Why Annuities Are Sometimes Grouped Differently

You may hear people ask, what are the 4 types of annuities, while others refer to only three. The difference usually comes down to how immediate annuities are categorized. Some professionals group immediate annuities separately based on timing, while others focus on how annuities grow (fixed, variable, indexed).

This is why discussions about types of annuity products can sometimes sound inconsistent, even though they’re describing the same tools.

Common Retirement Questions About Annuities

What Are the Three Main Types of Annuities?

The three main types are typically:

- Fixed annuities

- Variable annuities

- Indexed annuities

Immediate annuities are sometimes listed as a fourth category because of how income begins.

What Are the Four Types of Annuities?

When broken out fully, the four types are:

- Fixed annuities

- Variable annuities

- Indexed annuities

- Immediate annuities

This breakdown answers the common question: What are the 4 types of annuities? without overcomplicating the differences.

How Much Does a $100,000 Annuity Pay Per Month?

Monthly payments depend on factors such as age, gender, interest rates, and annuity type. As a rough example, a $100,000 immediate annuity might pay between $450 and $650 per month for life, though actual amounts vary.

What Is the 5-Year Rule for Annuities?

The 5-year rule generally refers to withdrawal and tax rules tied to certain annuity distributions. With some contracts, withdrawals made within the first five years may trigger surrender charges or tax considerations.

Which Annuity Option Is Best?

There is no single best option for everyone. The best type of annuity for retirement depends on income needs, risk tolerance, time horizon, and overall financial goals.

How Annuities Fit Into a Retirement Income Strategy

Annuities are not meant to replace all other retirement assets. Instead, they often complement Social Security, pensions, and investment portfolios by providing predictable income.

When used thoughtfully, annuities can:

- Reduce reliance on market performance

- Help manage longevity risk

- Provide peace of mind through guaranteed income

Choosing among the various types of annuity plans is less about finding a perfect product and more about aligning features with your retirement goals.

Choosing the Right Type of Annuity for Long-Term Retirement Income

Annuities can be powerful retirement income tools when you understand how they work and where they fit. From fixed and indexed options that emphasize stability to variable and immediate annuities designed for growth or income now, the many types of annuities offer flexibility for different retirement needs.

The key is clarity—knowing what each annuity does, what it doesn’t do, and how it supports long-term income planning. When annuities are used intentionally, they can help create dependable income and greater confidence throughout retirement.

See how annuities fit into a comprehensive retirement planning strategy and explore how the right mix of income tools can support your long-term goals with greater clarity and confidence.

EIA Income Advisors, Inc. is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The firm is not engaged in the practice of law or accounting.

We reserve the right to edit blog entries and delete comments that contain offensive or inappropriate language. Comments that potentially violate securities laws and regulations will also be deleted.

The information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of any topics discussed. All expressions of opinion reflect the judgment of the authors on the date of the post and are subject to change. A professional adviser should be consulted before making any investment decisions. Content should not be viewed as personalized investment advice or as an offer to buy or sell any of the securities discussed.

All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that an investor’s portfolio will match or exceed a specific benchmark.

Historical performance returns for investment indexes and/or categories usually do not deduct transaction and/or custodial charges, or advisory fees, which would decrease historical performance results.

Hyperlinks on this blog are provided as a convenience. We cannot be held responsible for information, services, or products found on websites linked to our posts.

Annuity and life insurance guarantees are subject to the claims-paying ability of the issuing insurance company. If you withdraw money from or surrender your contract within a certain time after investing, the insurance company may assess a surrender charge. Withdrawals may be subject to tax penalties and income taxes. Persons selling annuities and other insurance products receive compensation for these transactions. These commissions are separate and distinct from fees charged for advisory services. Insurance products also contain additional fees and expenses.

Social Security rules and regulations are subject to change at any time. Always consult with your local Social Security office before acting upon any information provided herein.